- home

- writing samples

- photos

- spreadsheets

Spreadsheets

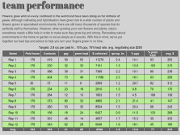

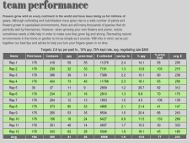

The team performance spreadsheet charts the performance to date of a call center team over a wide variety of performance parameters.Read more...

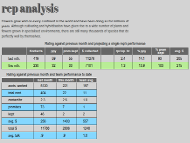

The rep analysis spreadsheet compares a rep's performance to the previous month and the team average.Read more...

- web interests

Some of my favorite links

Staying abreast of technology

MIT's Technology Review's mission is to identify important new technologies—deciphering their practical impact and revealing how they will change our lives.Read more...

Lifehacker offers tips, tricks, and downloads for getting things done.Read more...

-

contact

writing samples...credit

College students and credit

If you have a son or daughter on their way to college or currently enrolled, now is the time to start thinking about how they will handle issues related to credit. A good credit standing can have a positive impact on their job search when their college years are over. Most students, however, don’t realize how crucial this can be and oftentimes they cruise their way into a bad credit spiral.

Most major companies run credit checks on potential job candidates as a matter of course these days, so it is important that your offspring pay careful attention to their credit report if they hope to land that all-important first job. Two things are worth paying attention: choosing the right credit card and establishing credit though a “friendly” financial institution.

Credit Union sign-up

Let’s look at the second item first. I would recommend you enroll your son or daughter in a credit union as early in the game as possible. Most credit unions allow membership to families of credit union members while a few actually take “walk-ins.” If you have a family member who works for federal, local or state government, or who is a teacher, it is likely he or she belongs to a credit union and can sign you up for membership. This is completely different from co-signing and perfectly safe from a financial standpoint for the family member.

Credit Unions are great places to start a savings account. They also tend to offer free checking accounts and fairly gentle terms for car loans. Credit Union auto loans are often three to five percent below bank auto loans and are usually available after 6 months of membership. Rather than buy a car under your own name for a student going off to college, apply for an auto that you co-sign at the Credit Union. Even if you are the only one making the loan payments, at the end of four years of college, your child will have developed a track record that will show up as more than a blip on their credit report score.

Secured Credit Cards

Your offspring may choose to establish credit with a secured credit card or risk the commercial credit card offers that flood students’ mailboxes. There is a lot less risk involved with the former, which limits the amount of credit available to the extent of your deposit in a fixed account. After three to six months, their financial institution will convert the secured credit card to a regular card provided the payments have been made on time. Unfortunately, your son or daughter may decide to take matters in their own hands and take advantage of a hard-charging pre-approved offer.

Your only solution is to attempt damage control by educating your student on reading the fine print in these juicy offers. Most credit card offers trumpet zero percent offers for six to twelve months. Even experienced adults have a hard time looking pastthe zero in bold type and reading the print on the back of the offer. And astoundingly, some of these back pages are printed in lighter colored ink! The most important item on the back page will be what the credit card company will do to your child if they fail to make even one payment on time. Quite often, the zero percent rate will jump to 5 or 10 percentage points above the prime rate, and may thereafter rocket to 25 percent and beyond.

Incentive Program

If your college student has lost a job and is temporarily unable to pay their credit card bill, be prepared to step in and help out. And in order to ensure that you do not topple under the weight of their monthly payment, set up an incentive program before they go off to college. Draw up an agreement with your student that says you will pay $100 per month for two years on their credit card bill if they can prove they did not miss a payment through college. If they missed a payment, drop your offer to $50.00 per month, and if they missed two, your offer goes down to $50.00 per month for one year. Withdraw your offer if they have obviously made a hash of it throughout their college life.

Of course, it’s never to early to teach your children about the vagaries of credit and it’s best they learn at home, under supervision. Lessons learned before they go off to college may ensure that they enter the working world with a solid credit report and a good shot at saving themselves the burden of onerous interest rates later on.

Handling debt collection calls

At some point in our lives unplanned- for events befall the best of us and some can have far-reaching consequences. Take the loss of a job for instance. That’s a near certainty to occur to us a least once in our working lives and one of the consequences is likely to be falling behind on our bills. Unless you happen to leave your job with a generous severance package and have large pools of savings to draw on, chances are there are going to be some late payments ahead for you.

There are some bills you will continue to pay, no matter what, but there are others you will let slide. The electricity and water must continue to flow unless you relish camping in the backyard, but the tier two expenses like credit card payments, cable and cell phone bills and maybe even the car payment, will take a hit. Rather than cringe in fear waiting for the debt collection calls to come, you may as well buckle up and make a pre-emptive strike.

Making the call

Assuming you have the means to make some kind of payment, round up all your statements, list the balances and minimum payments along with the phone numbers and prepare to start calling. If you have been a good customer for a number of years, some creditors may actually grant you a grace period on your debt while you search for work. But you’ll never know unless you ask. The first call to your creditor is the most important. Bear in mind that you are going begging essentially and assume the humble position. And if the stars align in the right position on the day of your call, you may get a sympathetic account rep on the other end of the line. But you must be prepared to act your humblest best.

Most service companies spend small fortunes acquiring customers and are reluctant to lose long-term clients. If the account rep can’t suspend your debt payments, ask in the nicest fashion if they think a supervisor would be willing to bend the rules. That’s music to your account rep’s ear as they often are not paid well enough to go out on a limb and will be more than willing to pass you on to someone higher up.

Talk to the right person

Should you be unfortunate enough to get the village crank on the other end of the line, make an excuse to get off the phone by pretending to hear the baby crying. Even the crank will let you off easy without making derogatory statements in your account record if you are taking care of an alleged baby. Wait a couple of hours or until a shift change is likely after 5pm and call again. The next account rep you get may treat you completely differently.

State your case plainly, emphasizing that you are willing to pay your debt but you are between jobs. And ask for the moon. Some auto credit companies may have programs that suspend your payments for as much as three months while most will do at least two. Cell phone and credit card companies may agree to a two month grace period, but you will never find out until you pick up the phone. You may even offer to sweeten the deal by making a reduced debt payment for a fixed period of time but above all else, you must remain as polite and sweet tempered as possible no matter the circumstances.

If your calls turn out to be unsuccessful and your creditors demand full payment, focus on paying your most important bills first. You must keep the phone line on if you are job searching and you may want to consider signing up for dial-up internet service with a low-cost carrier lest you lose the broadband. Those two items, together with a working auto are crucial to your job search activities

Settling your debts

Should you be unfortunate enough to go through an extended period of unemployment, it may be necessary to dig yourself out of a mountain of debt. Rebuilding your credit report score should become a top priority once your cash flow position improves. Start by getting a copy of your credit report to see who has reported your missed debt payments and get a total of what you owe. You are now going to make a different type of debt collection call entirely; once again, politeness is the key and I’ll explain why in a moment.

Know that there are two ways to pay off debts that have gone bad. You can choose to pay in full or you can ask for a settlement. I tend to favor paying in full as the effect on your credit report score is more positive if you have a string of paid accounts than if your credit report shows “settled for less than the balance due.” That being said, if cash flow is a constraint and you want to get on with the rebuilding process, call your creditors and ask if they offer settlements. This will begin a process of bargaining during which you will suggest a modest percentage settlement but not one so outrageously low that you start off on a bad note with the account rep on the other end of the line.

You may even go so far as to ask that the settlement be split into three or four equal payments. If your debt is a year or older, many companies will agree to a sharp bargain rather than sell the debt for 10 cents on the dollar to a collection agency. The larger the debt, the lower the percentage you should offer, but do so in a spirit of amicable discussion.

Get it in writing

And should you be skillful enough to reach an agreement with which you can live, ask for the settlement agreement in writing. If they balk at knocking themselves out writing a letter, explain that your crusty uncle Joe is paying the debt for you and won’t part with so much as a dime unless he sees it in writing. Once you have secured the promise of a settlement letter, humbly ask if you will be able to get a paid letter at the end of the exercise and if they will be reporting to the credit bureaus after you have paid. If they tell you they do no issue paid letters, politely ask to be excused and call the next creditor in line.

Repeat the call

Repeat the process until you have your offers in hand and your paid letters secured in a safe place. Then check your credit report a month or two after you have paid the debt to ensure they have updated your record. If nothing has happened, your paid letters will be proof to the credit reporting bureaus that you have paid or settled your debt and they are required by federal law to upgrade their records.

One last tip remains. If your debt has been bought by a collection agency and you have any small doubt they will act ethically, pay nothing until you get a settlement offer letter, and pay with a method that ensures someone signs for your payment instrument and that carries some written record of the transaction.

SPREADSHEET DEVELOPMENT

Samples of my interest in performance analysis and training... FOLLOWLANDSCAPE PHOTOGRAPHY

Samples of my interest in landscape photography... FOLLOWAUTO PHOTOGRAPHY

Samples of my interest in automotive photography ... FOLLOWCONSTRUCTION PHOTOGRAPHY

Samples of my interest in construction photography... FOLLOWWEB DESIGN

Samples of my webpage designs... FOLLOWFormal Training

- Bsc. Business Administration

- HTML 3.2

- SAP FICO

- SAP BW/BI

Industry experience

- hotel management

- marketing management

- publishing/web design

- call center management

© May 2013 mmfDESIGNS

contact the webmaster if you have any questions or concerns

chief design officer: Mike McFarlane

mike mcfarlane's resume